Are you someone who values customer feedback as an irreplaceable asset? Would you like to know how to create surveys that gather detailed feedback and get a deep understanding of your customers? If yes, you’re in the right place.

“It takes humility to seek feedback. It takes wisdom to understand it, analyze it, and appropriately act on it.” – Stephen Covey.

This guide will help you create surveys that provide accurate and honest feedback to your company.

It will take you through the following sections:

- Different types of surveys

- When and how to use surveys

- Questions to ask when designing a survey

- Softwares that can help design and send a survey

- Understanding survey methods and how to analyze the data

- Knowing what might bias your results

- What can survey logic and branching do for you

Read on to connect with the customer base and create attractive feedback gathering tools.

Types Of Surveys and Their Use Cases

In this section, you will learn about the different types of surveys. With this knowledge, you can deploy a suitable survey per your needs and see immediate results and a higher response rate. I will cover Feedback Surveys, Product Surveys and Market Research Surveys.

1. Feedback or Customer Experience Surveys

“Your most unhappy customers are your greatest source of learning.” – Bill Gates.

It feels good to think about all the people your business has satisfied. However, to get a complete picture of your customer base, you should also analyze the unhappy customers.

The three feedback surveys mentioned below will empower you with tools that offer quantifiable results to take your business to the next level.

NPS Surveys

Suppose you want to know how likely your customer is to recommend your brand. In that case, the net promoter score survey is ideal.

The calculation is based on the percentage of ‘promoters’ minus ‘detractors.’

A net promoter system that produces a positive score is good. However, a net promoter score above 50 is even better, and over 70 is excellent.

CSAT Survey

You can use CSAT surveys as online forms to gauge the overall satisfaction of the customers.

It will be helpful to note that even though customers might not enjoy an experience with your product or service, they can still be loyal (see NPS) to your brand.

CES Surveys

If you want to know how much effort the customer put in to complete a specific action, you need the customer effort score.

Unlike the CSAT and NPS surveys before, CES surveys can help highlight a particular process from the entire experience.

In this section, we have looked at three feedback surveys. The key takeaways are as follows:

- NPS surveys help understand whether customers will recommend the brand or not.

- CSAT surveys highlight the overall satisfaction of customers.

- CES surveys tell you about customers’ efforts during a process.

2. Product Surveys

Product surveys focus on the product or service. It’s purpose is to map what customers think about the product in question and to help you improve it.

Five major benefits of using product surveys include:

- Testing usability

- Adjusting features

- Understanding customers

- Generating personal recommendations

- Making better business decisions

3. Market Research Surveys

“If you keep doing what you’ve always done, you’ll keep getting what you’ve always got” – Jim Rohn.

Kodak was once a market leader in photography. However, they didn’t evolve when digital photography hit the scene.

They had the wrong idea about being in the ‘film industry’ rather than the ‘storytelling’ industry. Kodak valued selling more products and not catering to the changing customer needs.

Marketing is not about promoting and selling the most product. It’s about providing a company’s customer base value and satisfaction.

Their closest competitor, Fujifilm, understood this. They conducted market research that best suited their goals while helping them understand their customers’ needs.

The following will help shed light on some of your options. Furthermore, some customers like having survey opportunities to have their voices and ideas heard.

Market Description Surveys

These surveys help you see your brand in comparison to your competitors. It provides vital information regarding market growth, market share, and the overall size of the market.

Market Profiling/Segmentation Survey

These surveys are perfect for identifying your customers and why they are your customers.

They are ideal for generating customer profiles helping you tailor your marketing strategies according to geography, demography, lifestyle, behavior, etc.

Tracking Surveys

Suppose you want to know the stage of the consumer in the adoption process (awareness, interest, evaluation, trial, adoption). In that case, tracking surveys are the way to go.

These surveys ask the same questions over an extended period. It can range from yearly to monthly, depending on your preference.

This section looked at market research surveys. You can take the following points away:

- Market Description Surveys – Useful for comparing your brand to the rest of the competition.

- Market Profiling Survey – Helpful in generating customer profiles.

- Tracking Surveys – Help you pinpoint the location of customers through their customer journey.

Customer Journey – The When

I classify the customer journey in three stages; awareness, consideration, and decision. The following table shows five questions you can ask the customers at each stage.

| Awareness | Consideration | Decision |

| The biggest problem you face with (product/service)? | What are your biggest worries about the problem? | Do any other companies come to mind when thinking about the product? |

| What bothers you most about (buying a product, completing a task)? | What’s the simplest way to solve the issue? | Who would you purchase from if the brands had different prices for fixing the problem? |

| What is your go-to solution for fixing this problem? | If you were to try (your brand), what would make you choose that option? | What is your go-to brand for fixing this problem? |

| What other ways have you thought about fixing the problem? | What are your thoughts on (your products)? | Have you tried another brand to solve this problem? |

| Have you thought about (your brand) for fixing this problem? | What rating will you give us based on these factors of buying from (your company)? | Do these features (advertisements) make you want to buy from us? |

Channels – The How

Have you created a completed survey? That’s great! All that is left is knowing how to ask your customers these questions. That is where channels come in. Nowadays many companies only do online surveys, but they have their advantages and disadvantages.

Let’s go over all the possible ways to survey your customers.

Email survey tools allow you to create, send, and manage email surveys in minutes.

With Trustmary, you can create a survey, and send it to your customers via email in less than 5 minutes.

The customer gets an email, where the first survey question is embedded.

This reduces the number of clicks needed, leading to a higher response rate.

Furthermore, automation allows you to trigger emails at specific intervals too.

Here are some tips for sending NPS email surveys to your customers to help you out.

SMS

SMS messages have a 98% open rate. Hence, it is one of the easiest and fastest ways to reach a broad audience and gather post-service data.

Phone Call

There is no replacing the human touch. A phone call allows you to interact on a deeper level with the clients and gather vital details.

While a smaller business can fo very well with just a mobile phone or a landline phone, larger international companies might benefit from a cloud phone system that enables multiple customer service agents to work on client calls.

Face To Face

Whether it is in the form of focus groups or one on one interviews, there is nothing quite like face-to-face questioning.

Social Media

Using social media to collect surveys is a good way to reach many customers in one go. Asking for a survey on social media also portrays your company as caring for the customers’ concerns.

QR Code

If it is made easily accessible, QR codes can be a highly effective, low-investment way of getting customers to take a survey. They are the best form of survey distribution for offline businesses, like event business, restaurants, spas, and so on.

In-Store

In-store surveys can be done using tablets or hard copies. They help you gather real-time feedback directly on site.

On Website

Website surveys cost almost next to nothing. They help promote customer engagement on the pages. With the help of Trustmary’s survey-maker, you can create online forms that showcase complete surveys at unique touchpoints of your website. Chatbots add a more personal touch to website surveys.

Which Questions to Ask On a Survey?

This section will cover everything you need to know about formulating the right questions. I will go through some general guidelines and cover various types of questions.

Keep the following types in mind to create surveys that get you a high response rate:

- Open-Ended

- Close Ended

- Rating

- Likert Scale

- Multiple Choice

- Picture Choice

- Demographic

Let’s begin.

As a general guideline, your survey questions should:

- Be clear and direct

- Achieve your survey goals

- Consider the user experience

- Not be biased

The following are some types of questions you can ask the customers, along with examples that you can use to create your online surveys.

Open-Ended

Open-ended questions allow the customers to explain themselves thoroughly.

They can highlight blind spots that you may not be aware of. Answering and analyzing the open-ended questions’ data can be a tiresome task. Hence, you might find customers hesitant to answer these questions. Yet, the value they provide cannot be overstated.

- How are you feeling?

- What was the best feature of the product?

Close Ended

Yes, or no, simple yet effective.

Close-ended questions are the opposite of open-ended questions. They are relatively easier to answer. Furthermore, it is easy for you to analyze their data too. However, they only reveal information that you already know.

- Did you order the lamb?

- Do you speak another language?

Open-ended vs Close Ended Questions

Rating

Ask your customers for a number.

Rating questions are efficient at finding out how well a product is performing, how consumers feel about it, and a quick comparison between various products. They are easy to answer as it only requires a tap or click. However, the results can be skewed by customers who exaggerate their answers.

- What rating would you give this app?

- Out of 5, how many stars will you give us?

Likert Scale

They offer great insight and are generally presented in 5, 7, or 9 points scales.

Likert scales expand on the simple yes or no questions. They are widely used in customer satisfaction surveys because they are quick to answer. Analyzing the answers to Likert scale questions allows you to dig deeper and find out more about a specific topic.

- How affected are you with changes in the office?

- Do you agree that x is better than y?

Multiple Choice

Make it easier for the customers by narrowing their choice of answers.

MCQs offer an easy survey-taking experience. They offer you clean and easy-to-analyze data sets. Furthermore, you can customize these questions to fit your specific needs. When designing MCQs, you must be careful about introducing biases in your answers. Customers might answer randomly if they see that their answer is not present in the options.

- How many hotels have you been to?

- What is the capital of the USA?

Picture Choice

One of the best ways to increase customer engagement.

Picture questions show the participants different images. They ask the customers to pick one. You can imagine picture questions being similar to MCQs with images. They can serve as a welcome break from reading text. Just ensure that the pictures you use are of high quality.

Demographic

A little personal, but perfect for segmentation.

Demographic questions are an efficient way to gather insight into your target audience. Furthermore, you can segment customers based on different factors by analyzing the results. It’s helpful to note that not all customers might be willing to divulge personal information.

- Where do you live?

- What is your gender?

The key takeaways from this chapter include general guidelines for formulating effective survey questions and different types of questions that you can use in your questionnaires. Be sure to keep these questions in mind when creating your survey.

Survey Templates (with Actionable Examples!)

This section will give you examples of how the best in the business go about creating their surveys.

University Of Texas, San Antonio

An in-depth customer satisfaction survey.

Source:

Ford

Ford offers its customers a survey that combines CSAT and NPS questions completely free.

Apple

The world leader in customer-centricity likes to go in-depth with the features in their products.

This section showed different sizes of surveys used by market-leading brands. By going over these examples of market-leading organizations, I am sure you can create outstanding online surveys.

However, wouldn’t it be nice if there is a survey tool that can help you with that?

Best Survey Softwares

This section will cover various softwares that function as survey creation tools. Some of these options allow you to approach customers through multiple channels and gather feedback. We will be looking at the following software:

- Trustmary

- Surveysparrow

- SurveyLegend

- Userflow

- WorkTango

Trustmary

Trustmary is a SaaS survey tool that allows customers to do surveys while simultaneously collecting and using testimonials.

Survey Types Available:

- NPS

- eNPS

- CSAT

- CES

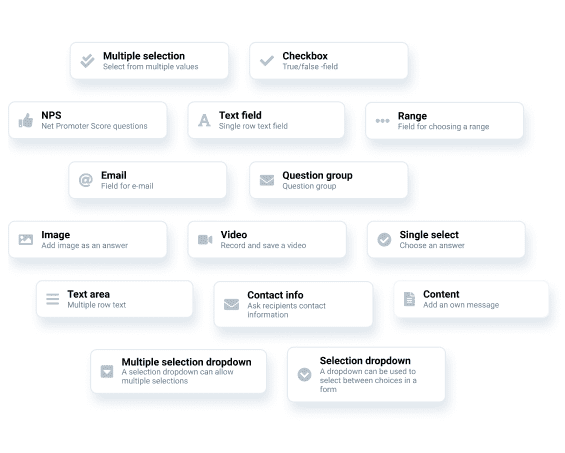

Question Types Available:

- NPS

- Text field

- Text area

- Checkbox

- Multiple selection

- Single select

- Multiple selection dropdown

- Selection dropdown

- Range

- Star rating

- Question group

- Add an image or video as a response to question

- Contact information

Along with ways to integrate social proof on your website, it also offers a drag and drop survey builder tool that allows you to build customizable feedback forms.

You can fully integrate Trustmary with your CRM to give the access to the customer satisfaction data to all relevant parties. No need to transfer data between systems, let the integrations do the work!

Surveysparrow

Surveysparrow enables you to transform surveys into conversions. This software adds a conversational tone to the surveys making their forms highly engaging. The easy sharing options allow you to share your surveys over many platforms.

SurveyLegend

SurveyLegend is another cloud-based software that boasts a simple-to-use user interface.

It can help you customize the survey to match your branding and displays the data in eye-catching graphics.

Userflow

Userflow is an onboarding software that allows your entire team to build in-app surveys.

It’s praised for being powerful and advanced to handle complex UIs while being user-friendly.

Stamped

Stamped is designed to help eCommerce companies to get reviews and build a customer loyalty program.

Additionally, users can also send out different types of surveys to customers via email, SMS or embed directly on website.

To conclude:

- Trustmary allows you to create customizable feedback forms which also simultaneously collect testimonials. The testimonials can then be showcased easily on your company’s website with innovative testimonial and review widgets.

- Surveysparrow helps you create engaging surveys and share them over many platforms

- SurveyLegend is easy-to-use and creates surveys that match your branding style.

- Userflow invites your entire team to customize the surveys. It is powerful enough to handle complex Uis.

- Stamped gives users access to reports which help in seeing trends and topics within the gathered customer feedback.

Survey Methods

By now, you know everything to create online surveys. But how can you apply them effectively and conduct various studies? That is the scope of this section.

By the end of this chapter, you will learn about:

- Cross-sectional studies

- Longitudinal studies

- Correlational studies

1. Cross-Sectional Studies

- Cross-sectional studies are used to collect data from a sample for a particular period.

- There are two types of cross-sectional studies. The analytical research dives into the how and why of an outcome. In contrast, the descriptive study summarizes and shows the results using statistics.

- They are cheap and need less time to complete. Furthermore, you can study and collect multiple variables at the same time.

- However, using this study, it can be challenging to find behavioral patterns and observe changes over time.

2. Longitudinal Studies

- Longitudinal studies are conducted over a long period to examine the change in individuals. Thus, it requires repeated observations of the same group.

- There are three basic types of longitudinal study; panel, cohort, and retrospective.

- A panel study involves a sample from a population. This study gathers data from the same sample over an extended period.

- A cohort is a group of people who experience a similar event at a given point in time. For ease of understanding, clinical trials are considered cohort studies.

- Lastly, the retrospective study uses data that already exists. This data has been collected during previous studies conducted using the same variables.

- This type of study is perfect when you want to observe trends. Furthermore, you have more flexibility to collect data you might not have thought about.

- However, the study’s higher costs, longer times, and overall complexity might put some people off.

3. Correlational Studies

- Correlational studies allow you to observe the relationship between two variables quickly. For example, in market research, the study might include the effect of increasing advertisement and sales.

- Only three types of correlation exist. A positive correlation means that increasing one variable increases the value of the variable.

- A negative correlation means that increasing the value of one variable will decrease the value of the other.

- Zero correlation means no connection between the two variables and that changing one will not affect the other.

Correlational studies are used where conducting experimental practices is unsafe or unethical. Furthermore, it is a cost-effective way to collect a lot of data.

It will be helpful to keep in mind that you can only observe the statistical relationship between the variables by conducting this study. Moreover, you can’t observe the relationship between more than two variables.

To sum this section up, we have learned that:

- Cross-sectional studies help you take a snapshot of the current situation and target pressing concerns.

- Longitudinal studies are ideal for viewing the effects of a long-term business strategy.

- Correlational studies aid you in making more precise and impactful predictions based on relationships between variables.

Survey Data Analysis

So you narrowed down the questions you wanted to ask. You used the latest software to distribute the online survey. Data has started coming in. It is time to analyze the results.

This section is all about finding the best way to analyze the data gathered from surveys. By the end of this chapter, you will learn various ways to analyze data best-suited to your business. We will cover:

- Cross-Tabulation

- Trend Analysis

- MaxDiff Analysis

- Conjoint Analysis

- TURF Analysis

- Gap Analysis

- SWOT Analysis

- Text Analysis

Let’s begin.

Cross-Tabulation

Cross tabulation is a quantitative method that analyzes the relationship between two or more variables. It is a great tool that helps manage large quantities of data while uncovering insights you might have missed.

Trend Analysis

As the name suggests, trend analysis allows you to look at data over a long time. Thus, it helps observe any trends that might show up.

This analysis can be perfect for observing upcoming threats and opportunities

MaxDiff Analysis

Also known as the best-worst scaling, the MaxDiff analysis allows you to observe the relative preferences of customers.

A MaxDiff with 4 to 5 items to rank is easy for customers to answer. Furthermore, it helps the customers narrow down on their most valued preference.

Conjoint Analysis

This method aims to collect multi-level preference data. Furthermore, it helps get to the heart of the customers’ preferences about your products and services.

There are various types of conjoint data analysis, each with unique uses. Some of these types are:

- Choice-based

- Adaptive

- Full profile

- Rating or ranking

- Menu-based

TURF Analysis

Total Unduplicated Reach and Frequency or TURF analysis determines the numbers of customers reached via a communication source.

It asks questions like: “What will the obtainable market share be if we launch product x?”

Gap Analysis

The ‘Gap’ in gap analysis refers to the distance between the actual and expected performance.

The gap analysis tells you about your level of business compared to industry standards at a strategic level. However, it can also give insight into the current state of performance compared to your business goals at an operational level.

SWOT Analysis

If you are looking for an analysis method that helps determine the company’s competitive position, opt for SWOT analysis.

This method highlights fact-based strengths, weaknesses, opportunities, and threats of the organization.

The goal is to build on the strengths while nullifying the weaknesses. Furthermore, you should keep an eye out for opportunities while monitoring threats to your organization.

Text Analysis

Text analysis can help you bring order to a huge amount of data set. One of the most popular and visually appealing ways is using word clouds.

However, there are other ways, such as coding (converts words to numbers) and tags (filters specific terms).

Beware These Survey Biases

In order to get actually mindful results in your surveys, you need to bear in mind that there are factors that might affect them.

We brushed on some of the earlier, but here’s a more comprehensive explanation.

Survey bias refers to different factors that distort survey results.

Sometimes it has to do with the survey itself: maybe it’s confusing or maybe it leads respondents on in an undesirable way. Other times, it has to do with the respondent’s personal circumstances: maybe they are not willing to answer, or maybe they don’t complete it all the way through.

It’s important to note that you cannot fully avoid survey biases. They are always present. However, you can interpret your results better when you are aware of them.

Here are a couple biases you want to pay attention to:

1. Non-Response Bias

Non-response bias occurs when people don’t answer your surveys.

It might be cause by one of the following reasons:

- No interest in your survey

- Your survey is too long and people don’t complete it

- The survey is confusing, which prevents people from completing it

- Technical problems

- Forgetting to answer

- Don’t want to answer, for a reason or another

The implications of non-response bias might be that your results do not accurately represent the sample group’s actual opinions. It’s problematic especially if the survey is intended for a set group.

Example: you want to find out what your family members think about the cake you baked for grandma’s birthday. You send them a survey to rate the cake, and you get a shining review – but only a few answers.

You think you are the best baker ever, but the reality is that most family members skipped the survey because they didn’t like the cake, but also didn’t want to upset you.

(And then there is aunt Margaret who didn’t know how to open your survey link on the new fancy smartphone, and cousin Jack who was too busy with the punch and forgot about the whole thing).

Take time to analyze if there is a specific group of people who skip your survey.

Things you might try to fix non-response bias:

- Send reminders/ask again

- Offer incentives for respondents

- Make the survey more interesting

- Offer different ways of answering the survey (pen and paper for aunt Margaret)

- Check for any technical issues and confusing questions

2. Question Order Bias

Sometimes, the order in which your questions and answer options are presented can affect the answers, and lead to biased results.

For example, people are more likely to choose options that are higher on a list (especially if they are not very engaged to answering your survey and want to just get it over with).

Additionally, one question might guide the respondent’s thoughts in a specific direction. If you first ask what the respondent’s favorite holiday resort is, and next you ask where they would like to travel next, it might well be the same answer again.

In contrast, if you first ask where they would like to travel, and only after it ask about their favorite resort, the answer might be less guided.

To avoid question order bias, you can try shuffling the questions and response options.

3. Sampling Bias

You might majorly bias your survey results if you don’t pay attention to the quality of your sample group.

If you only choose people who represent one group or opinion, you will get answers accordingly. In this case, you can’t confidently say that this is what all people think – it only represents the opinion of a specific group.

Things that affect sampling bias:

- Too small sample group

- Demographically limited group

- Only asking from people that have already made their stance clear about your research topic.

It doesn’t mean you should always try to include everyone in the sample group: not at all. It’s important to choose the right representation for your surveys.

But keep that in mind when analyzing the results. If you conduct a customer survey about the quality of your company’s customer service, but only send the survey to one customer service agent’s clients, you won’t learn what customer service looks like in your company. You will find out what people think about this particular person.

4. Acquiescence Bias

Acquiescence bias is a phenomenon when people agree with your survey excessively, without actually agreeing with you, or answering “yes” even when it contradicts the previous answers.

There can be different causes for it:

- The respondent doesn’t actually think about the responses but wants to just quickly complete the survey, thus always choosing the same option.

- Respondent wants to save your face (some cultures are more adamant about it than others).

- There is no “in the middle” or a neutral option to choose, so they choose the affirmative even though they don’t have an opinion.

The same can go the other way: someone might answer with “no” or disagree. These biases can also be described as extreme response biases.

5. Neutral Bias

The opposite of acquiescence or extreme response bias is the neutral bias, in which people always choose the middle or neutral option. Something along the lines of “not agree or disagree”, “I don’t know”, “I don’t have an opinion”.

It might happen for the same reasons as above, but also because they genuinely have no opinion about the issue.

You can easily avoid neutral bias by not including neutral answers, but then you will drive yourself into the direction of extreme response bias.

This further proves that you simply cannot completely avoid survey bias.

Key Takeaways from This Section

- Cross-Tabulation allows you to examine relationships between two variables

- Trend Analysis gives you a comprehensive look over an extended period.

- MaxDiff Analysis helps you see customer preference with ease.

- Conjoint Analysis is a wonderful technique to understand what your customers value.

- TURF Analysis helps increase efficient deployment of new products and services.

- Gap Analysis can be used externally or internally to compare your current position with the market or expected position.

- SWOT Analysis is ideal for an overall look at your company’s internal factors.

- Text Analysis is perfect for compiling raw data into neat structures.

- You need to be mindful of how you arrange your surveys in order to get legitimate results.

Survey Logic And Branching

Imagine designing a survey that changes appearance, behavior, and content based on the customers’ answers. That is what survey logic allows you to do.

By using features like text substitution, answer masking, question routing, and in-survey calculations, you can design various branches that help you tailor the experience of answering a survey.

Branching allows you to filter customers by the questions they answer. Thus, you can streamline the entire process for the customer and yourself.

Branching and skip logic, in particular, help you identify the most valuable customers.

For example, you can show one block of survey questions to people who own your product and an entirely different block to people who don’t own your products.

To Sum It All Up

No matter if you opt for doing traditional surveys or online surveys, you should start doing them regularly. Preferably right away.

The benefits of doing so include:

- Improved customer experience as your customer feel valued when you ask for their honest feedback

- Increased customer loyalty, when you figure out what’s wrong and fix the issues

- Surveys help you get actionable insights from your whole brand

This guide took you through the what, how, when, and more of surveys.

It covered the following topics:

- Different types of surveys and their specific uses

- Survey questions for particular points in the customer journey

- Channels used for distributing surveys

- The various types of questions to ask in surveys

- Online survey templates of major companies

- Various offline and online survey softwares

- Different survey methods and techniques to analyze survey data

- The benefits of using survey logic and branching

So what are you waiting for? You have all the tools available to create as many surveys as you want. However, if you want to learn more, please feel free to check out the link below.

FAQ

How often should you survey your customers?

- It is a good practice to survey your customers through various touchpoints of their customer journey. Try this survey editor for each touchpoint of the customer journey.

- For recurring surveys, you shouldn’t survey them before 90 days.

- However, you could survey them before that for more immediate insights regarding changes.

How many survey answers do you need to make generalizations from answers?

- It depends on the sample size of the entire population and the margin error you are willing to accept.

- Suppose you are surveying a population of 500 people and want to remain within a 10% margin error. In that case, you only need 80 people to answer the survey.

- However, suppose you want to decrease the margin error to 5%. In that case, you need 220 people to answer the survey before you make generalizations.

Question: How many questions should my survey have?

- As a general rule, your survey shouldn’t take more than 10 minutes to complete. This article, ‘How to Create Effective Survey Questions,’ will help you out.

- To hit that mark, you should aim for five to ten questions.

- However, if the questions are descriptive and open-ended, then reducing their number is beneficial.